📌 What is Corporate Tax (CT)?

Corporate Tax (CT) is a direct tax levied on the net income or profit of corporations and other entities from their business operations. In the UAE, CT is governed by Federal Decree-Law No. 60 of 2023, which amends provisions from Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses.

This marks a transformative shift in the UAE’s business landscape—one that every company must now account for.

💼 Who is Subject to Corporate Tax?

Corporate Tax applies to:

- Businesses and individuals conducting activities under a commercial license in the UAE.

- Free zone businesses, provided they comply with all regulatory requirements and do not conduct business in the UAE mainland.

- Foreign entities and individuals, if they conduct trade or business regularly in the UAE.

- Banking operations.

- Real estate businesses involved in management, construction, development, agency, or brokerage activities.

💰 CT Rates

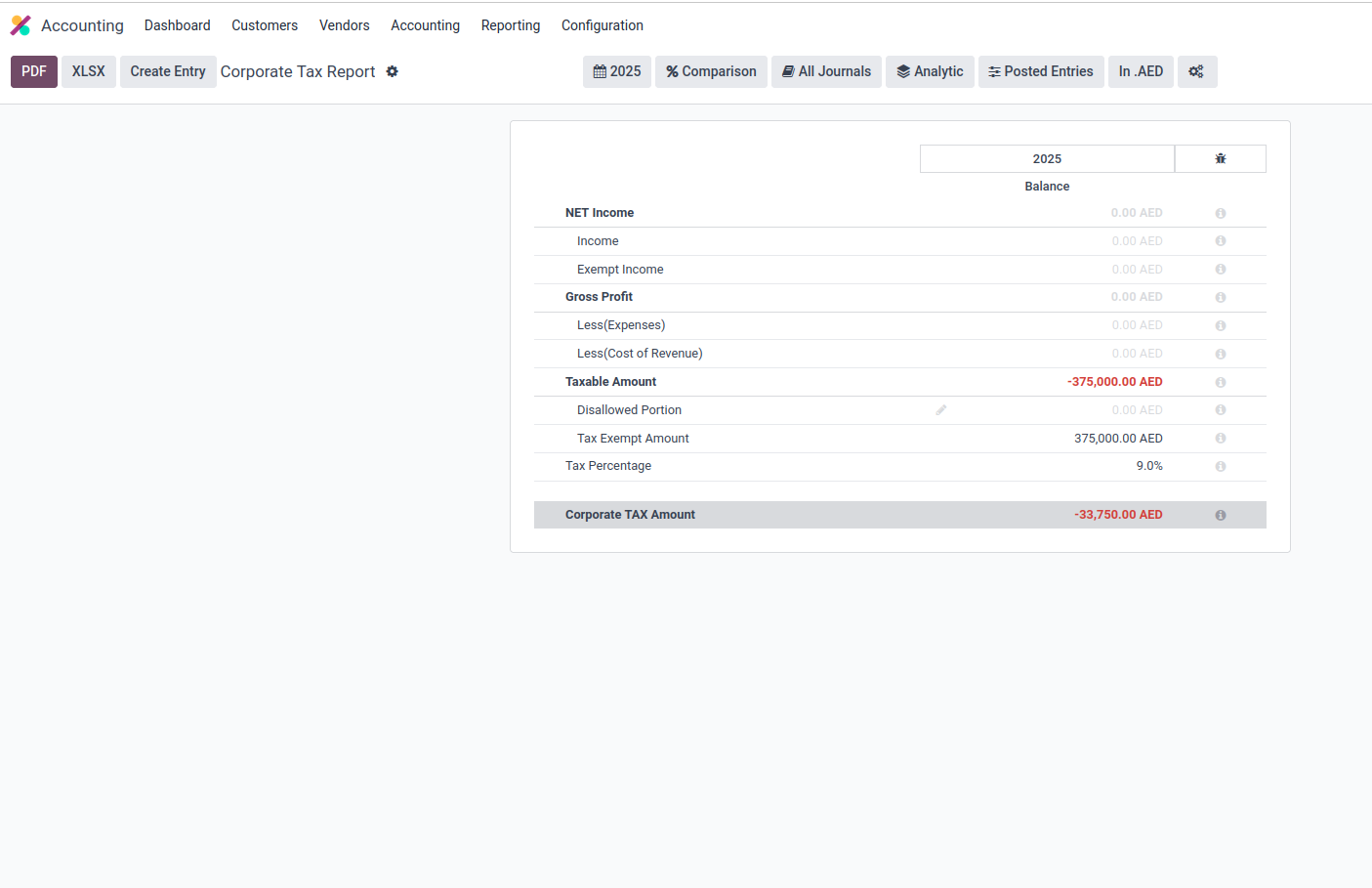

According to the UAE Ministry of Finance, CT rates are structured as follows:

- 0% on taxable income up to AED 375,000

- 9% on taxable income above AED 375,000

- A special rate (yet to be specified) for large multinationals, based on OECD’s Pillar Two framework for Base Erosion and Profit Shifting (BEPS)

✅ How Odoo Helps You Manage Corporate Tax

Managing this new tax framework manually can be a headache—but Odoo makes it easy.

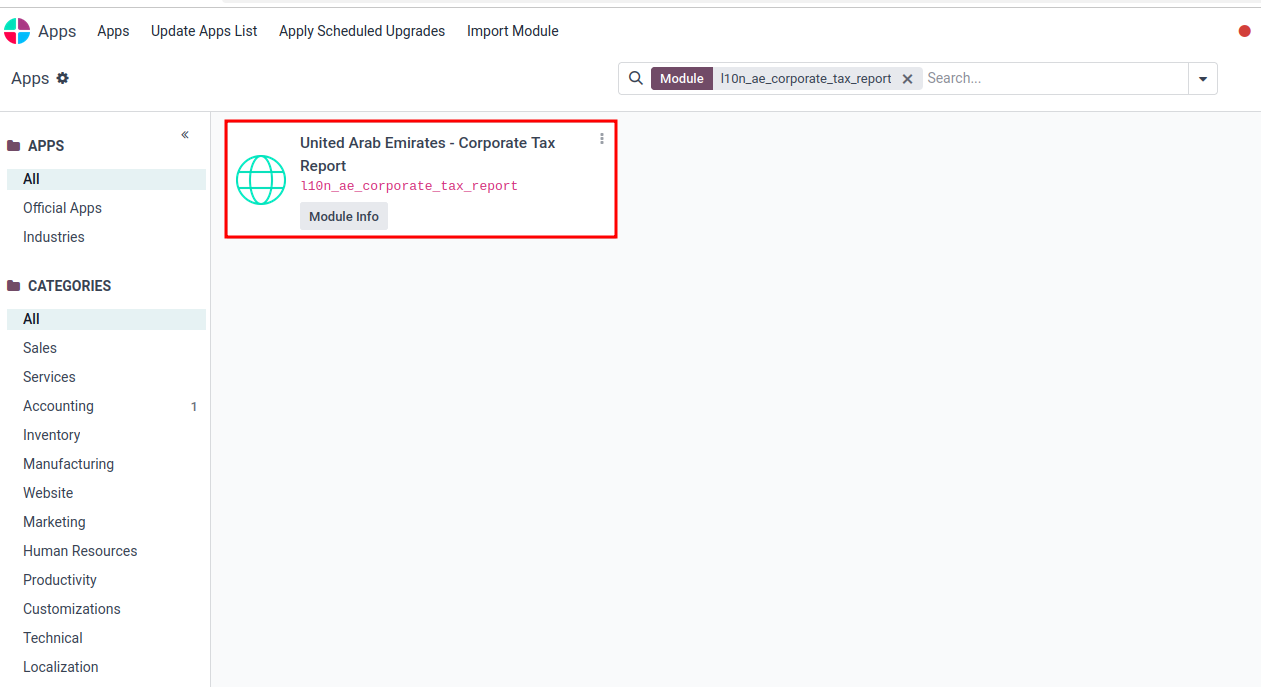

With the United Arab Emirates - Corporate Tax Report module

(l10n_ae_corporate_tax_report), you can:

- Track taxable profits with clarity

- Automate tax calculations

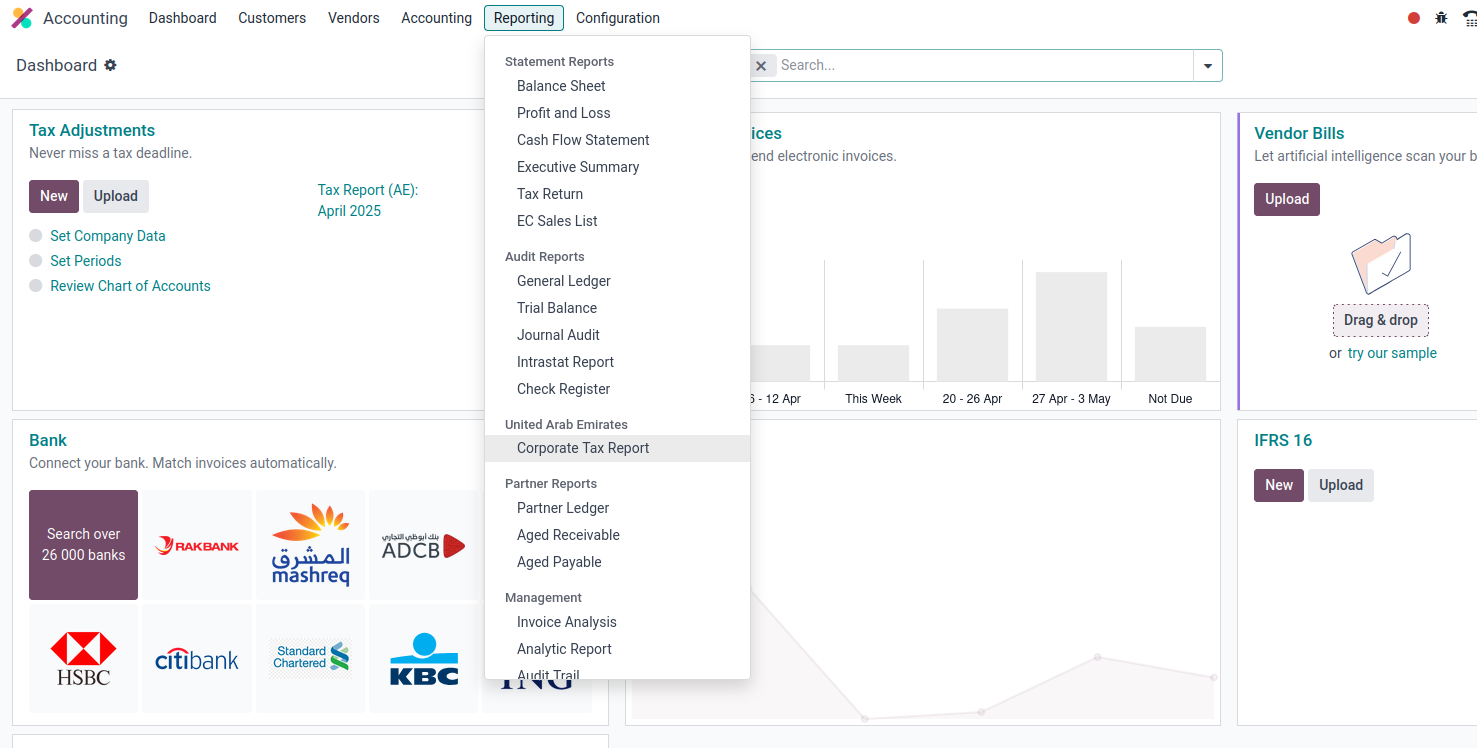

- Generate and configure CT reports tailored to UAE localization

- Stay compliant with evolving regulations

⚙ How to Get Started

1. Install the module: l10n_ae_corporate_tax_report

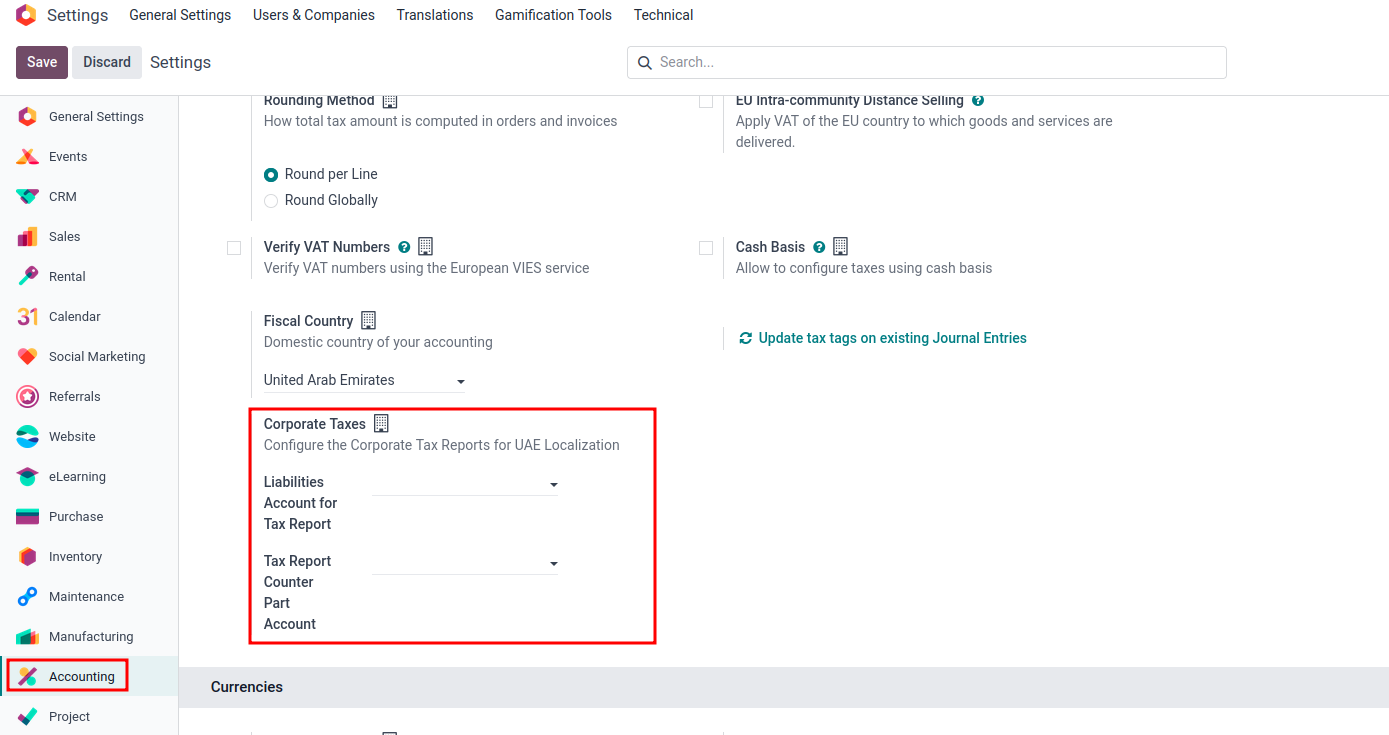

2. Configure your settings: Ensure your company’s financials are correctly localized for UAE standards

3. Generate reports: Access your CT data from the Reporting menu in Odoo

4. Stay audit-ready: Odoo ensures your CT documentation aligns with legal obligations

🚀 Final Thoughts

The UAE’s implementation of Corporate Tax marks a bold step toward global tax alignment. But for businesses using Odoo, this doesn’t have to be a burden. With the right configuration, you can adapt quickly and confidently.

Whether you’re a startup, SME, or enterprise, Odoo gives you the tools to:

- Track and manage taxable profits

- Calculate corporate tax with precision

- Generate compliant tax reports on demand

🤝 Need Help?

We specialize in configuring UAE Corporate Tax in Odoo. If your business needs support

getting started or optimizing its CT reports, reach out to us—we’re here to help.

United Arab Emirates - Corporate Tax Report in Odoo